Measures to Help Prevent Check Fraud

In today’s world, built in security features and anti-fraud measures are potentially the most sought after added value capabilities of any accounting system. According to the 2016 AFP Payments Fraud and Control Survey, checks continue to be the payment method most often targeted with 71 percent of companies experiencing actual or attempted check fraud. Don’t wait until you realize that you have been a victim of check fraud. Your existing Sage 50, Sage 100, QuickBooks desktop, and QuickBooks Online accounting systems have either built-in or add-on applications that can make your vendor payments more secure.

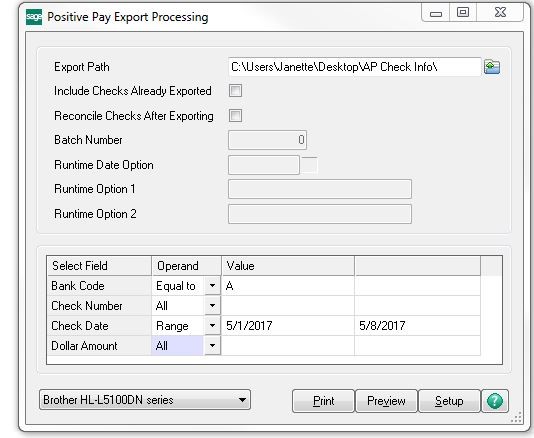

Take a Look at Positive Pay

More and more banks are requiring their corporate customers to participate in a variety of bank-sponsored systems designed to decrease fraudulent access to your account information and the checking accounts themselves. Perhaps the most prevalent of these systems is commonly known as Positive Pay, and in fact, certain banks now require customer participation in this program.

Briefly stated, Positive Pay is an automated fraud detection tool offered by the Cash Management Department of most banks. In its simplest form, this service matches the account number, check number and dollar amount of each check presented for payment against a list of checks previously authorized and issued by the company. You might think, sounds great but also sounds like a lot of extra work for me. Fortunately, there are either built-in or add-on applications that can help automate this task. For more information on specific on solutions for your accounting system, contact us at 973-808-9040 or [email protected]

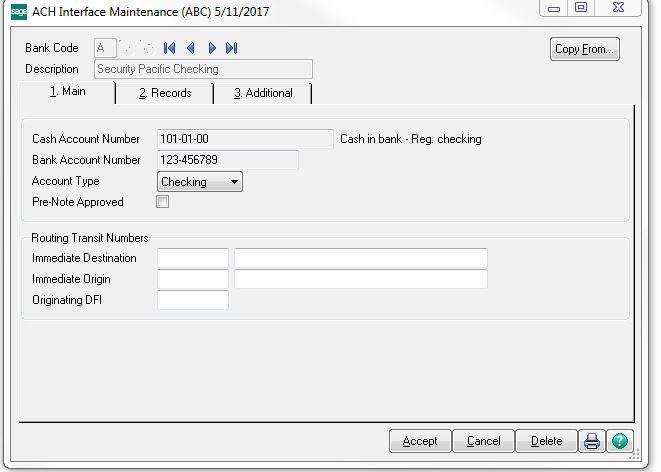

Take a Look at ACH and Electronic Payments

Along similar lines, the cash management departments of many banks are encouraging customers to pay vendors electronically, and in fact, certain vendors are requesting this payment method. Like Positive Pay, this process requires approval from and setup with your financial institution, as well as detailed account number and routing number information for each of the vendor bank accounts that will receive funds in this manner. ACH completely eliminates physical checks including their associated printing, postage, and processing costs. Similar to Positive Pay, there are either built-in or add-on applications that can help automate this task. For more information on specific on solutions for your accounting system, contact us at 973-808-9040 or [email protected]