NJ Sales Tax Decrease for 2018 – Sage 100 Instructions

In accordance with the changes in New Jersey Sales Tax to be effective January 1, 2018, below please find appropriate instructions for updating you Sage 100 accounting system.

1. On December 31, 2017 (or the last day of actual billing for 2017) update all invoice data entry in Sales Order and Accounts Receivable.

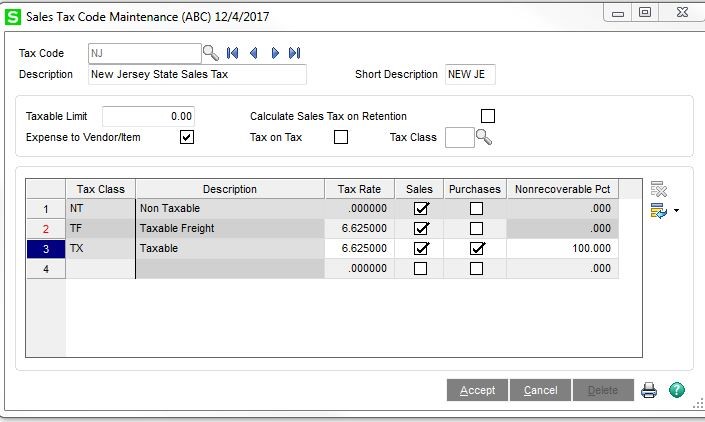

2. Before commencing with any actual billing for 2018, in Library Master, Setup, go to Sales Tax Code Maintenance and edit the applicable Tax Class lines to change the Tax Rate from 6.875000 to 6.625000 (see example)

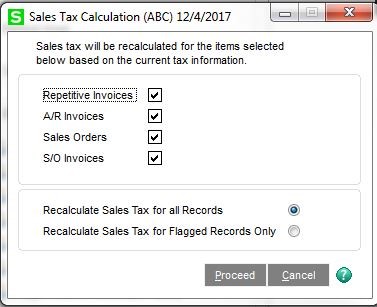

3. From the Accounts Receivable, Utilities menu, run the Sales Tax Calculation utility as indicated below.

This procedure will adjust the outstanding Sales Tax calculation for quotations and unshipped orders as well as repetitive invoices. If you never charge Sales Tax, no action is required at this time.

If you have any questions or require assistance with this matter, please do not hesitate to contact our office at 973-808-9040.